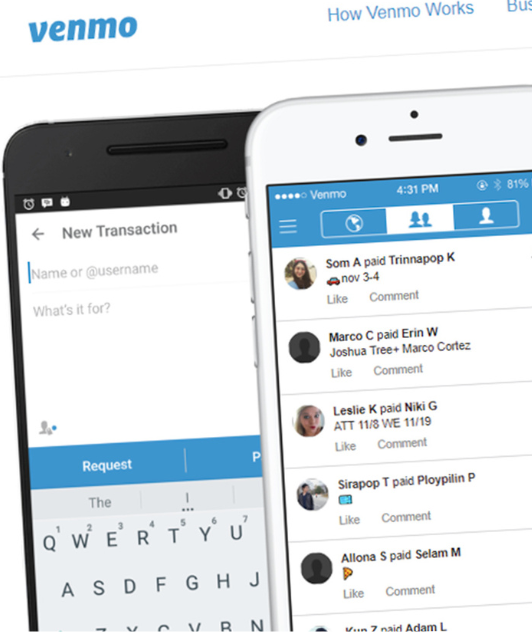

Venmo for Business Transactions

Venmo isn't just for splitting dinner anymore. With the rise of mobile-first commerce, Venmo for business transactions is becoming an accessible option for small business owners and independent contractors. This guide helps you understand how to set up a business profile on Venmo and accept payments legally and securely. Learn how to leverage the social-powered network for visibility and grow your business while offering customers a convenient way to pay.

Features

- Create A Verified Venmo Business Profile With Distinct Branding

- Accept Credit/Debit And Venmo Payments Via Qr Code Or App

- Track Transactions Separately From Personal Activity

- Set Up Custom Descriptions For Transactions

- View Insights On Customer Behavior And Transaction History

- Lifetime rates that won’t increase

- Enable Tipping Options During Checkout

- Simplified Tax Reporting With Categorized Business Income

Zelle for B2B Payments

Zelle for B2B Payments Using Zelle for B2B payments is gaining popularity among professionals and small business owners who want to send and receive funds quickly between bank accounts. Zelle integrates directly into most major banking apps, making peer-to-peer business payments seamless and bank-approved. This service is ideal for B2B transactions that prioritize speed, low cost, and ease of use.

Features

- Direct Bank-To-Bank Transfers Without Third-Party Apps

- Funds Usually Arrive Within Minutes

- No Processing Fees For Most Participating Banks

- Works With Small Businesses, Freelancers, and Sole Proprietors

- Supports Recurring Payments And Invoice Links

- Reduces Dependency On Cash Or Paper Checks

- Built-In Bank-Level Security

Instant Transfers for Small Business

Instant Transfers for Small Business Speed matters for small businesses, and instant transfers for small business payments help maintain cash flow, especially for daily expenses, vendor payments, or payroll. With platforms offering real-time payment capabilities, businesses can access funds instantly after a transaction, without the traditional 1-3 day delay.

Features

- Immediate Access To Funds From Customer Payments

- Available Via Major P2P Platforms And Business Banking Apps

- Great For Businesses With High Transaction Volumes

- Optional Instant Transfer Fees (Typically 1% Or Less)

- Helps Streamline Vendor Payments And Cash Flow

- Compatible With Digital Wallets and POS Systems

- Improves Liquidity For Time-Sensitive Expenses

Support at no additional charge !

Peer-to-Peer Payment Apps Guidance

Choosing the right peer-to-peer payment apps for business use can be overwhelming. This guidance provides small business owners and freelancers with expert tips on using consumer-grade platforms safely and effectively for commercial purposes. Understand the risks, legal considerations, and best practices when using apps like Cash App, PayPal, Venmo, and Zelle for business-related transactions.

Features

- Comparison of Leading P2P Apps For Business Suitability

- Tips On Separating Personal And Business Funds

- Guidance On App Features Like Invoicing, Receipts, And Limits

- Legal Compliance Insights (E.G., Irs 1099-K Reporting)

- Helps Identify Platforms Offering Business-Specific Accounts

- Advice On Minimizing Fraud or Disputes

- Best Practices For Transparent, Trackable Payments