By Rinki Pandey October 26, 2025

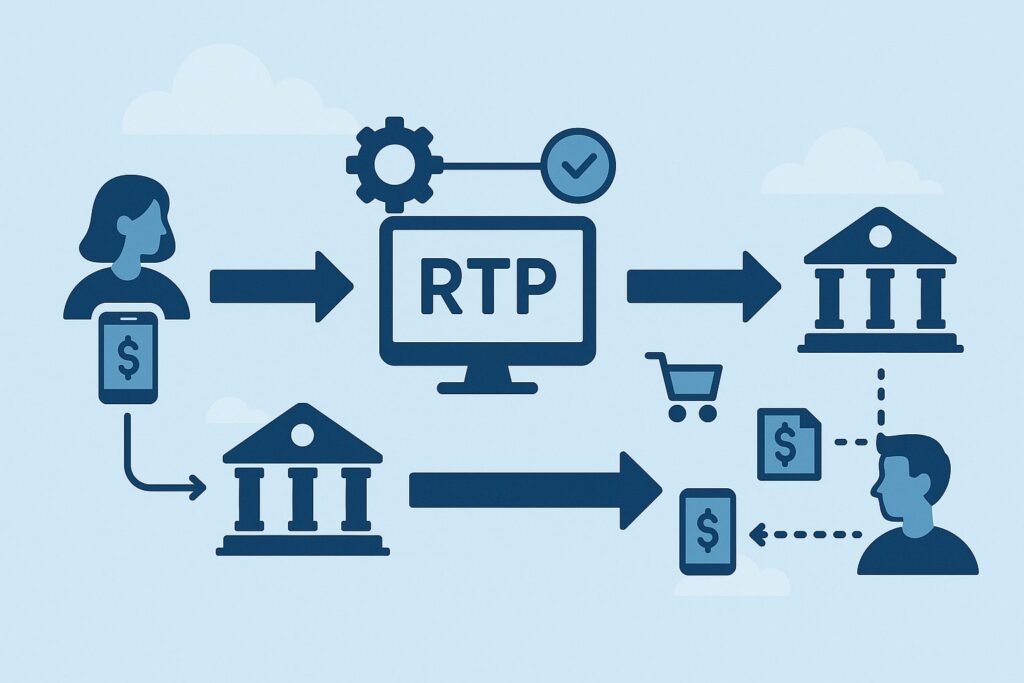

Real-time payments (RTP) for small businesses refers to U.S. instant payment rails that move money and confirm settlement in seconds, 24x7x365, with immediate funds availability and finality.

In 2025, two primary instant rails matter for small firms: the bank-owned RTP® network from The Clearing House (TCH) and the Federal Reserve’s FedNow® Service.

Both are credit-push only (the payer authorizes the transfer), run continuously (no bank “business hours”), and use ISO 20022 messages that support rich, structured remittance data helpful for reconciliation and accounting.

For a U.S. small business, “RTP for small businesses” means faster cash flow, instant confirmations, fewer exceptions, less weekend or holiday delay, and a foundation for modern use cases such as instant supplier payouts, emergency payroll, just-in-time inventory, point-of-sale account-to-account (A2A) acceptance, and real-time invoice settlement using Request for Payment (RfP).

The TCH RTP network is mature and widely used by banks and credit unions. FedNow is newer but growing and adds a public-sector backbone for instant payments that any depository institution can join. Both are designed to complement—rather than replace—existing rails like ACH, wires, and cards.

For small businesses, the question is less “if” and more “how fast” they can adopt RTP for small businesses to improve working capital, reduce card fees on certain transactions, and offer a payment experience customers now expect: instant, verified, and always on.

Why “Always-On, Instant, And Final” Matters To Small Firms

For a small business, liquidity is oxygen. RTP for small businesses turns days of settlement lag into seconds, even on nights, weekends, and federal holidays. Immediate posting reduces collections risk and eliminates ambiguous “pending” statuses that complicate fulfillment and customer service.

Finality is equally important: once an instant payment is accepted, it settles and cannot be unilaterally pulled back like some card or ACH debits, which can help reduce chargeback anxiety when you’re delivering goods or releasing inventory.

With ISO 20022 data traveling with the payment, invoices can be auto-matched and books can be closed faster, improving accuracy and reducing back-office workload. Importantly, both RTP rails are credit-push only, so customers must consent to send funds, lowering unauthorized debit disputes.

FedNow and the RTP network operate 24x7x365 with real-time interbank settlement; funds are available to the receiver right away. That combination—always-on clearing, finality, and rich data—is the core value proposition of RTP for small businesses in 2025.

How RTP Rails Actually Work (End-To-End)

At a high level, RTP for small businesses follows a similar flow whether you’re on the RTP network or FedNow: the payer’s bank validates the transaction, sends a credit transfer over the instant rail, the receiving bank accepts (or rejects) within seconds, and settlement posts immediately to both banks’ accounts.

Funds are available to the receiver right away, with confirmation messages returning to both banks and—through them—to payer and payee. These rails are not batch systems; they settle transaction-by-transaction, with clearing and settlement integrated.

Both support Request for Payment (RfP), a non-value message that lets a payee (e.g., your business) request a specific amount with an invoice reference; the payer reviews and authorizes an immediate credit in response. RfP improves bill pay, B2B invoicing, and recurring collections without storing payers’ sensitive details.

The TCH RTP network documents message types and operational specs in its technical library, and the Federal Reserve publishes public operating procedures and readiness guides that describe the payment flow, acceptance windows, and required funds-availability practices.

If you’re scoping RTP for small businesses, your bank or payment provider will map these flows to your accounting, ERP, or POS systems via APIs or file formats aligned to ISO 20022 fields so that reconciliation is automatic and auditable.

Request For Payment (RFP) And Rich Remittance Data

RfP is the secret weapon of RTP for small businesses. Instead of pushing an invoice PDF and hoping someone pays, your system issues an RfP through your bank or provider to the customer’s bank.

The customer sees the pay request with the amount, due date, invoice number, and a memo—then taps “Pay.” The instant credit transfer fires, the funds post, and both sides receive confirmations.

TCH expanded RfP availability and continues to publish rules and education for participants, while FedNow includes RfP in its initial feature set and market practice guides. Because RfP messages use ISO 20022, they can carry structured data (for example, invoice references and line-item details) that your ERP can match automatically.

That means fewer exceptions, less “mystery money,” and faster month-end. For small businesses juggling lots of smaller invoices, RfP shrinks days sales outstanding (DSO) and replaces “check is in the mail” uncertainty with immediate, confirmed settlement.

If you adopt RTP for small businesses, prioritize RfP support in your selection criteria so your customers can self-serve payments right from their banking apps without keying in routing/account numbers.

RTP vs. FedNow vs. Same Day ACH vs. Wires and Cards

When you compare rails, think speed, reach, limits, cost, data, and consumer experience. RTP for small businesses means instant settlement and confirmation; Same Day ACH is fast (same day), but still batch-processed with specific submission windows and end-of-day posting.

Traditional ACH (next day or two) is cheapest but slowest. Wires are fast and final but expensive and usually limited to banker hours. Cards provide ubiquitous consumer acceptance and protections, but they involve interchange and chargebacks that many small businesses want to minimize in certain use cases.

In 2025, Same Day ACH allows up to $1 million per payment (still subject to cut-off times), while the TCH RTP network has raised its individual transaction limit to $10 million, unlocking higher-value B2B use cases.

FedNow currently supports default participant limits of $100,000, with many institutions able to raise up to $1 million, and the network has announced an increase to $10 million beginning November 2025 (institutions may phase in based on risk programs).

For a small business, that means most invoices and payouts can already be handled over instant rails, with headroom for larger transactions continuing to grow—especially on the TCH RTP network today and FedNow later this year.

Picking The Right Rail Per Use Case

RTP for small businesses doesn’t mean “use one rail for everything.” Match the rail to the job. Use RTP/FedNow when immediacy, confirmation, and after-hours settlement matter (e.g., paying a supplier to release a shipment tonight, paying a contractor at job completion, refunding a customer instantly to preserve goodwill).

Use Same Day ACH when you need broad reach at lower cost for payments that can be posted later in the day (e.g., payroll corrections, rent remittances that aren’t urgent). Use wires for very large transfers to parties that expect wire workflows and fees.

Keep cards for checkout scenarios where rewards, chargeback protections, or interchange economics make sense. Over time, many small businesses blend these rails: instant rails for urgent payouts and receivables via RfP; Same Day ACH for scheduled same-day runs; ACH for routine bulk; cards for consumer POS and ecommerce.

The goal is orchestration: the most efficient, secure rail for each transaction, with your systems doing the “smart routing” so staff doesn’t have to think about it. That’s the practical way to implement RTP for small businesses while controlling cost and risk.

2025 Limits, Fees, And Operating Rules You Should Know

Limits are dynamic, and 2025 has been eventful. TCH RTP increased its single-payment limit to $10 million (effective February 9, 2025), significantly expanding high-value B2B potential on that rail.

FedNow participants typically have a $100,000 default limit that FIs can raise (up to $1 million) based on their risk posture, and the network has announced a $10 million network maximum starting November 2025; institutions will choose how to implement that ceiling locally.

Same Day ACH remains capped at $1 million per payment, with multiple settlement windows but not true 24x7x365 operation. Both instant rails are 24x7x365 with immediate funds availability and final settlement; FedNow documents the real-time funds-availability requirement and operational timelines in its readiness guides and operating procedures.

Pricing varies by institution and provider, but many small businesses find per-item instant fees competitive with—or lower than—card acceptance for certain ticket sizes, especially when RfP shifts customers to account-to-account payments.

Always verify your bank’s RTP/FedNow price schedule and any per-file or monthly access fees. If you want the latest network ceilings and participant options for RTP for small businesses, bookmark official pages and check quarterly; limits have been trending upward.

Settlement Model, Cut-Offs, And Posting

Unlike ACH, there are no daily cut-offs on the instant rails. That’s a big deal for RTP for small businesses—ship a part at 11:59 p.m. and get paid at 11:59 p.m. Settlement on RTP and FedNow is immediate and final when the receiver’s bank accepts the payment.

FedNow explains this continuously available model in its readiness and customer-flow documents, and TCH publishes business principles and continuous-operations specifications for the RTP network.

Practically, you’ll see payments posted within seconds; if a payment is rejected, you’ll also know quickly, with a reason code that your system can use to alert staff. For risk control, your bank may require prefunding or intraday liquidity arrangements for outgoing payments, but that doesn’t change the receiver’s immediate availability.

This finality and clarity simplifies inventory release, digital good delivery, and after-hours operations—all reasons RTP for small businesses is increasingly part of the day-to-day toolkit.

Priority Use Cases: Where Rtp Delivers Outsized Value

Think in workflows, not just payments. The best RTP for small businesses implementations tie instant settlement to operational triggers.

Instant Invoice Settlement And B2B Bill Pay With RFP

Send an RfP from your invoicing system that includes amount, due date, and invoice ID. Your customer reviews and authorizes the payment in their banking app; funds land in seconds, and your ERP auto-closes the receivable.

Compared to card or ACH debit, this lowers interchange/chargeback exposure and avoids storing customers’ account credentials. TCH has broadened RfP availability and continues to refine rules and education, while the Fed makes RfP guidance and market practices public.

For professional services, distributors, and trades accepting deposits or milestone payments, RfP-driven RTP for small businesses shrinks DSO, improves cash conversion cycles, and reduces staff effort spent on dunning and matching.

Many small firms pair RfP with QR codes on invoices or in-person displays so customers can “scan-to-pay” from their mobile banking app—no portal logins or card typing.

Supplier, Contractor, And Marketplace Payouts

When goods need to move now, instant supplier payments unlock release of inventory and shorten lead times. Contractors and gig workers appreciate immediate payout at job completion; it’s an effective recruiting and retention lever.

RTP for small businesses also helps marketplaces pay sellers instantly upon order confirmation or delivery confirmation, improving seller satisfaction and reducing support tickets. Because credits are final when accepted, there’s no waiting to see if the money “sticks,” which reduces operational holds.

With the RTP network’s higher limit and FedNow’s rising ceiling, even larger supplier invoices fit on instant rails, particularly in industries like logistics, construction, and wholesale distribution where timing is everything.

Use bank-approved controls—per-transaction caps, velocity limits, multi-factor approvals—to protect against misdirected or fraudulent payouts while keeping the experience fast.

Emergency Payroll, Refunds, And Customer Appeasements

Missed a payroll file? A key employee needs an off-cycle deposit? A shipment went sideways and you need a refund tonight? RTP for small businesses lets you solve cash-sensitive problems in minutes rather than days.

FedNow’s funds-availability rules and Fed-published customer-flow explain how deposits post immediately; TCH’s always-on settlement model yields the same benefit. For refunds and appeasements, instant payouts can turn an escalated support case into a loyalty moment—especially after hours or on weekends.

Many small firms build simple back-office workflows (“trigger instant refund if NPS < X”) to automate these moments. Just remember: instant rails are credit-push.

For payroll, you’ll push to employees’ accounts rather than pull, and you’ll want to coordinate with your payroll system or provider for tax and stub handling while using the instant transfer for the net pay.

Risk, Fraud, Compliance, And Controls (Practical Playbook)

No rail is “risk-free,” and RTP for small businesses deserves thoughtful controls. Because instant credits are final, you must treat authorization, payee verification, and change-management (e.g., “new bank account” requests) with rigor.

Use dual-control approvals for higher-risk amounts, whitelist known counterparties, and leverage your bank’s negative-list and participant-level limits where available.

FedNow details participant-level risk tools (e.g., network/participant transaction limits and negative lists) in its materials, and TCH publishes RTP rules, participation terms, and guidance for requests to return funds (for specific scenarios where both banks cooperate).

Educate staff that phishing and business-email compromise (BEC) remain threats regardless of rail; call-back verification on changed bank instructions is still table stakes.

Invoicing via RfP reduces exposure to credential theft because customers never share routing and account numbers with your business; they authenticate and authorize inside their own bank apps.

Align your instant-payment usage with your internal payment policy, vendor master controls, and a documented exception process. When implemented with layered controls, RTP for small businesses significantly reduces operational and dispute risk relative to cards and debits for many scenarios.

Finality, Errors, And Returns (What Happens If Something Goes Wrong?)

Instant rails are credit-push and final upon acceptance—there are no unilateral chargebacks. However, both networks include processes for Request for Return of Funds when money is misdirected or fraudulently obtained; success depends on counterparty cooperation and speed.

The Clearing House trains participants on Request for Return of Funds, and its rules/education cover responsibilities and liabilities. FedNow’s operating procedures similarly define how institutions handle payment inquiries and exception processing.

For small businesses, build a “rapid response” checklist: immediately alert your bank, contact the counterparty, file internal incident reports, and freeze further related payments. Avoid “manual entry” by staff wherever possible—use templates, saved beneficiaries, and approved RfP flows to reduce fat-finger risk.

Finally, remember that consumer Regulation E error-resolution rules apply to electronic fund transfers on consumer accounts; your bank or provider will guide how those obligations intersect with instant credits if your customers are consumers.

The key is prevention: tight initiator controls, strong authentication, verified payees, and least-privilege access to payment functions.

Implementation Guide: Getting From Idea To Live In 30–90 Days

Rolling out RTP for small businesses is mostly an enablement and integration project with your bank or payment provider. Start by confirming whether your primary bank supports send, receive, and RfP on (a) RTP, (b) FedNow, or both. Some institutions are receive-only at first; that’s fine for getting paid via RfP while you plan outbound use cases.

Next, decide scope: collections (RfP), payouts, or both. Map each use case to your systems: invoicing, ERP, accounting, POS, marketplace, or gig platform. Ensure your provider exposes ISO 20022 fields so remittance data flows cleanly into your ledger.

For controls, configure per-payment and daily limits, approval chains, and whitelists. Pilot with a handful of customers or vendors who value immediacy; monitor KPIs like DSO, refund resolution time, and staff hours saved.

Document a playbook for exceptions and a rollback plan for any misfires. Keep your team trained on fraud red flags and secure change-management for bank details.

Because limits and features change, assign someone to check official updates quarterly (TCH document library and FRBservices pages). This pragmatic approach gets RTP for small businesses to live quickly without boiling the ocean.

Integration Patterns And Vendor Checklist

If you prefer low-code, pick a provider that offers hosted RfP links/QRs and a simple payout API. If you have engineering resources, integrate directly or via your bank’s partner gateway with webhooks for payment confirmations.

Your vendor checklist for RTP for small businesses should include:

(1) support for both TCH RTP and FedNow (future-proofing),

(2) full RfP create/cancel/expire flows,

(3) ISO 20022 data mapping to your ERP/GL,

(4) real-time webhooks and dashboards,

(5) granular limits, dual approvals, and negative lists,

(6) strong customer authentication options and device fingerprinting,

(7) audit trails and exportable logs, and

(8) transparent pricing

Validate cutover and rollback plans, as well as sandbox environments that simulate acceptance/rejection scenarios. Ask how the provider handles document exchange if you plan to include invoice PDFs or supporting files in RfP flows—TCH supports document exchange on RTP and many providers expose it.

Finally, verify your bank’s liquidity and prefunding model for outbound RTP so you don’t run into limits at month-end. Done right, integrating RTP for small businesses is less about “payments” and more about end-to-end cash-flow automation.

Costs and ROI: Making the Business Case

The ROI of RTP for small businesses shows up in cash conversion, operational savings, and fee optimization. Faster settlement shortens DSO and reduces the need for working-capital financing. Real-time confirmation reduces “Where’s my payment?” support contacts and lets you ship sooner with less risk.

RfP can shift some receivables from cards to account-to-account payments, trimming interchange and chargeback overhead where appropriate. Instant refunds lower churn and increase customer satisfaction, especially when a quick resolution averts a negative review.

Fees for instant payments vary, but many banks price them competitively with cards for small-to-mid tickets. On the cost side, plan for one-time integration and training, and budget for provider/platform fees.

To make your case, baseline key metrics—average DSO, return/exception rate, refund resolution time, staff hours per 1,000 payments, and card mix—and target improvements after rollout.

Cite the networks’ 24x7x365 availability and rising transaction ceilings (TCH at $10M today; FedNow at $1M with a network increase to $10M coming in November 2025) as proof these rails are scaling for bigger use cases your customers will expect.

Compliance Snapshots you Can Share with your Bank and CPA

Banks will ask about your KYC/KYB, OFAC screening, fraud controls, and segregation of duties for payment initiation. Have your vendor master policy ready, including how you verify new payees and bank-account changes (out-of-band confirmations, two-person approval).

If you take consumer payments, understand your obligations for error resolution and dispute handling, and coordinate with your bank’s procedures for FedNow or RTP exceptions. Keep copies of your payment policy, RfP acceptance terms, and privacy notices if you’re collecting customer data (for example, to send RfPs via email/SMS).

For audits, maintain logs of who created, approved, canceled, or refunded RfPs and payouts. Both the Fed and TCH publish operating and participation rules; referencing official rules in your documentation shows maturity and reduces onboarding friction.

This is where ISO 20022’s structured data helps your CPA tie payments to invoices and revenue recognition cleanly—another underrated win of RTP for small businesses.

Frequently Asked Questions (FAQ)

Q1) What are the 2025 transaction limits for RTP and FedNow?

Answer: For TCH RTP, the single-payment limit is $10 million (effective Feb. 9, 2025). For FedNow, many banks set a $100,000 default that can be raised to $1 million today; the network has announced a $10 million network limit starting November 2025 (your bank may opt in and set local limits accordingly).

Same Day ACH allows $1 million per payment but is not 24x7x365. Always confirm your bank’s specific settings. These ceilings make RTP for small businesses viable for most invoices and payouts.

Q2) Is RTP available at my bank?

Answer: Most large U.S. banks support the RTP network and a growing number support FedNow. Some institutions are receive-only while they finalize outbound and RfP features. Ask your bank which instant rails it supports (send/receive/RfP) and whether it exposes APIs or file-based integrations.

TCH and FRBservices maintain public documentation, and your bank can share its specific implementation and timelines. RTP for small businesses continues to expand as banks add features.

Q3) Are instant payments reversible if I make a mistake?

Answer: No. Instant payments are final upon acceptance. There are processes like Request for Return of Funds, but they require cooperation and are not guaranteed.

Prevent errors with dual approvals, whitelists, and verified payee data. Train staff to treat instant credits like cash. This finality is a core reason RTP for small businesses reduces chargeback risk relative to some other rails.

Q4) How does RfP compare to sending an invoice with ACH or cards?

Answer: RfP lets you request an instant credit directly through the customer’s banking app, carrying structured invoice data for automatic reconciliation. Unlike ACH debits, you don’t store the customer’s account credentials.

Unlike cards, there’s no card-number handling or chargeback exposure. For many invoices, RfP-driven RTP for small businesses is faster, safer, and cheaper—while still delivering a polished customer experience.

Q5) Can I accept consumer payments over RTP/FedNow online or in-store?

Answer: Yes, if your bank/provider supports RfP or account-to-account checkout features. Many small firms add “Pay by bank (instant)” to checkout and invoices. Customers authorize in their banking app; you get instant settlement and confirmation.

Start with higher-ticket items or where delivering goods is delayed until payment clears (services, deposits, special orders). This is an easy on-ramp to RTP for small businesses without replacing your card stack.

Q6) How do instant rails compare to Same Day ACH?

Answer: Same Day ACH posts the same day within scheduled windows and supports up to $1M per payment, reaching nearly every U.S. account—excellent coverage but not 24x7x365. Instant rails post in seconds, at any time, with confirmation and finality. Choose the rail based on urgency, cut-off risk, data needs, and cost. Many small firms use both.

Q7) What about weekends and holidays?

Answer: Both RTP and FedNow operate around the clock, 365 days a year. If you need to release orders on a Sunday night, RTP for small businesses means you can get paid and ship immediately, with no banking-day delays.

Q8) Do I need new accounting software?

Answer: Not necessarily. Many banks and providers map ISO 20022 remittance fields into common accounting/ERP systems. Confirm that your vendor supports real-time webhooks, invoice-ID capture, and exportable audit logs. That’s enough to make RTP for small businesses work with your current books.

Q9) How soon will FedNow support very large payments?

Answer: FedNow’s network limit is slated to increase to $10 million in November 2025. Your FI will decide whether—and when—to adopt the higher ceiling and what participant-level limits to set. Keep in touch with your banker for the go-live date and risk controls.

Q10) What should my first step be?

Answer: Ask your bank about instant-rail support (send/receive/RfP) and pricing. If receive-only is available, start by getting paid via RfP while you prepare outbound payouts.

Set limits/approvals, pilot with a few trusted customers/vendors, and measure DSO, exception rate, and staff time saved. That’s the fastest path to value with RTP for small businesses.

Conclusion

RTP for small businesses is no longer experimental—it’s a practical, high-ROI tool to accelerate cash flow, reduce friction, and improve customer and supplier experiences.

The rails are mature, the limits are rising (TCH RTP at $10M today; FedNow’s increase announced for November 2025), and RfP brings invoice and bill-pay into the instant era with rich, auto-reconcilable data.

Start small: add an RfP “pay by bank” option to invoices, pilot instant refunds, and wire supplier payouts through instant rails when timing matters. Lock down your controls (dual approvals, whitelists, verification calls), integrate ISO 20022 fields to your ERP, and keep an eye on official updates each quarter.

By aligning the right rail to each workflow, you’ll turn payments from a back-office cost into a competitive advantage—one your customers will feel every time funds land in seconds, any day, any time.